You want to grow your business, not worry about HR compliance.

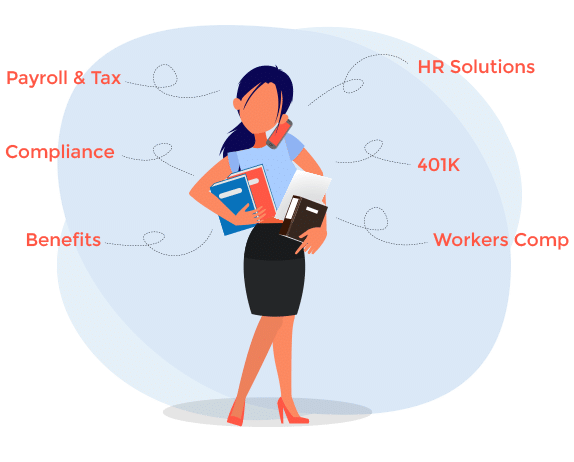

That’s where we come in. We’re your single-source HR partner, here to support your team and let you stay focused on your daily work and business growth. So, what are your goals? Take the mystery and stress out of compliance? Better payroll and workers’ comp management? Offer a better benefits package (while saving money)? We can help with all of it.

Comprehensive HR Solutions

Payroll & Tax

Administration

Never worry about deadlines, regulations, or tax filings again.

Human

Resources

Develop and communicate effective policies based on your company’s unique needs, current government legislation, and industry best practices.

Risk

Management

We show you how to minimize risk and costs, allowing you to maximize your productivity and return on investment.

Custom Benefit

Solutions

DES offers a multitude of benefit options to meet your business needs. Together we’ll build a program that works best for you.

The DES Client Journey

You’re on the right path! Each step of this Journey is designed to help us first understand your unique needs and challenges, then offer the most effective solutions possible.

Let’s keep it simple and take one at a time together.

STEP 1

Discovery

Tell us about your specific challenges, your business, and your goals. This will help us offer the best-informed ideas and solutions.

STEP 2

Detailed Assessment

Our experts will review your current HR procedures, looking for ways to build on your efficiencies while identifying areas of potential risk.

STEP 3

Plan Design

We will present and deliver a comprehensive, custom-tailored HR plan designed for you and your business.

STEP 4

Plan Implementation

In partnership with you and your team, we will implement your new plan.

STEP 5

Your Partner in Success

The Journey doesn’t end here – it’s just beginning. We will be your strategic partner as you navigate challenges and grow your company, offering personalized service and support.

Service Offerings that Grow with Your Business

Carefully designed to provide you the exact services you need as your company grows.

Core service offerings

A la carte service options

PEOs represent

13.7%

of all employment by private sector employers that have 10 to 99 employees.

(NAPEO)

“I love calling and never getting a recording – I get a real person who knows me”.

“I value the personal touch that is really lost in most places these days”.